Hello Interactors,

As the rain returns to the northwest it’s time to summon even more motivation to get outside for exercise. I established a bit of a fitness pattern this summer and I’m motivated to keep it up. But the rain isn’t the only thing holding me back, so is my body and my mind.

As interactors, you’re special individuals self-selected to be a part of an evolutionary journey. You’re also members of an attentive community so I welcome your participation.

Please leave your comments below or email me directly.

Now let’s go…

THE DEVIL MADE ME DO IT

As part of my Monday fitness routine, I begrudgingly slog jog up a steep hill in my Market neighborhood, zig-zag my way through gravel alleys, down calm side streets, and through occasional narrow easements that snake between homes guarded by fences and barking dogs. Some called this route the ‘Market wiggle’.

It drops me onto an arterial road that skirts along a wooded wetlands. I suffer as I shuffle on a rolling narrow strip of painted bike lane for about a half a mile where I’m presented with a decision. Do I keep running up a gradual hill to achieve more distance or do I face the challenge of ascending a wall of over 100 steps that climb up a steep grade to my destination. It’s a short cut, but also a glute burn.

My destination is an outdoor gym plopped on a patch of asphalt nestled in the corner of an expansive park made of grassy ball fields and scattered pines. I have my routine: a series of upper body exercises on machines that leverage my body weight. I do pull-ups (kind of), seated bench press, and sit-ups. I usually have the place to myself. Though I was once surprised by an eager and excitable white toy poodle. As I was doing sit-ups he ran up behind me and licked the salty sweat off my face.

Upper body fitness has never been my favorite. It’s a necessary evil that seems to be getting harder all the time. But I have my repetition goals and I’m determined to improve. Pullups are the hardest. After a summer of just holding my chin above the bar, I’m finally getting to a point where I can actually pull myself up. (kind of)

My forearms don’t much like supporting my weight. I finish my routine and head back home. Just across from the park is a the middle school track. It’s a cinder track; a relic in the rainy northwest where most tracks have turned artificial. On the weekends I do a timed mile. I can’t help but be disappointed in my time and progress. I just can’t run as fast as I used to.

I also beat myself up over my lack of progress. I should be getting faster by now. I should be able to do more pullups. A battle in my brain ensues.

DEVIL: If you lose weight, maybe you can run faster and do more pullups.

ANGEL: Yeah, but you’re not really overweight – in fact, you’re maintaining a healthy weight because you’re running.

DEVIL: Unless, of course, the extra weight is coming from the added muscle mass from all those stair climbs, and upper body work.

ANGEL: But you can’t stop doing upper body work. You know you’ve been losing muscle mass since the day you turned 30.

DEVIL: C’mon, dudes older than you can run faster than this. You can’t run faster until you start running faster. And you just have to keep doing more pullups if you want to do more pullups!”

Then an independent interloping inquisitor interrupts; “Why are you trying to run faster? Why is the number of pullups important? What is your goal? Is it to increase the number of pullups and decrease your running speed, or is it to maintain your health?”

It’s hard to rally behind asymptotic performance plateaus. Just ask any aging professional athlete. And it’s depressing to consider that as long as that plateau may be, its end is punctuated by a certain mortal decline. I am fully aware of my body’s limitations in this race with mortality, but my mind is trained to expect, and even crave harder, better, faster, stronger.

WHAT GOES UP, MUST COME DOWN

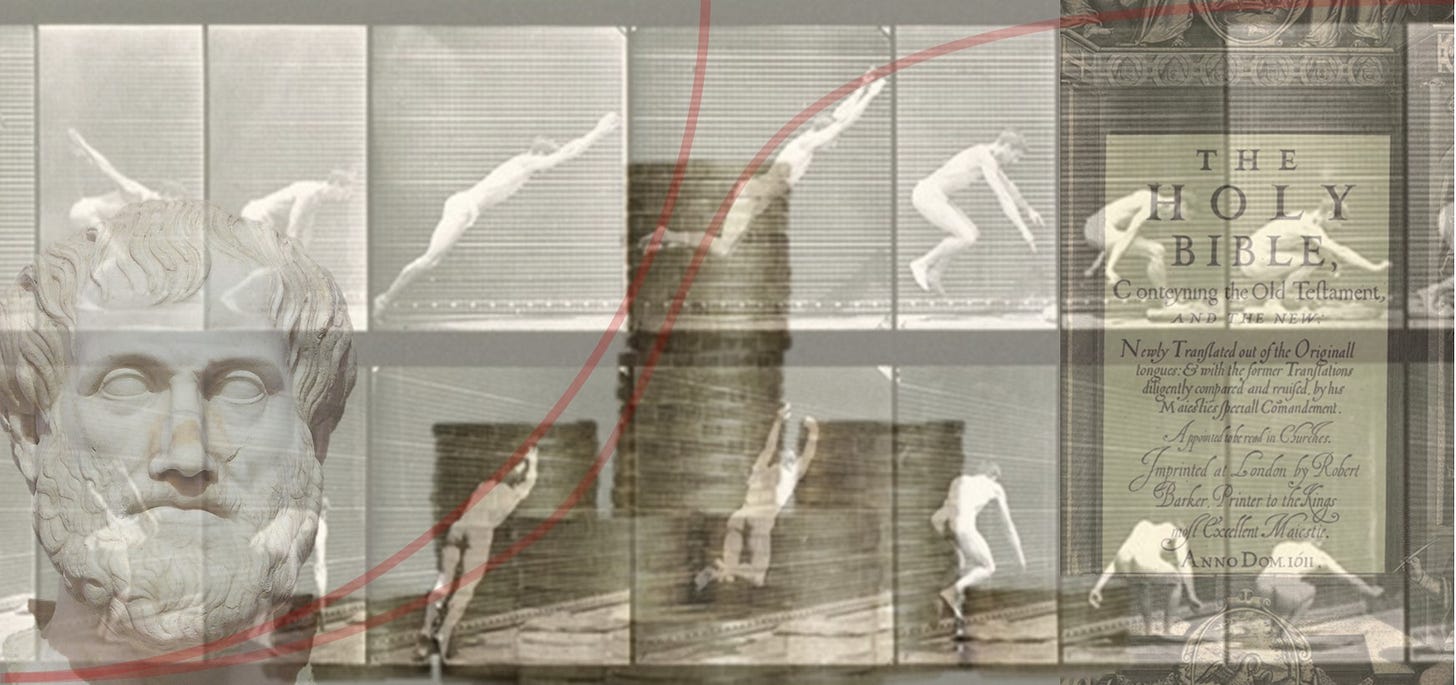

We are all trained by a culture infused with metaphors that lead to a desire to increase growth and optimize time. In 1980, two cognitive linguists, scientists, and philosophers, George Lakoff and Mark Johnson wrote a seminal book called Metaphors We Live By. They give examples of how orientation concepts and words like up and down shape how we think and act.

You can see evidence of it in the words I’ve already written. I was beating myself up and feeling down because the number of pullups wasn’t going up. I get depressed when my running times fall off. My athletic abilities are declining as I near the height of my physical abilities. Have I reached a peak? I am now longer in top shape. As my age slowly climbs up, my abilities will be sinking fast. What if I come down with an illness? My health will decline. And one day, I will drop dead.

They suggest other metaphorical orientation concepts by category:

HAPPY IS UP AND SAD IS DOWN.

I’m feeling up. I fell into a depression.

FORESEEABLE FUTURE EVENTS ARE UP (and AHEAD)

What’s up on the agenda? I’m afraid of what’s ahead of us.

HIGH STATUS IS UP, LOW STATUS IS DOWN

She’ll rise to the top. He’s at the bottom of the hierarchy.

MORE IS UP, LESS IS DOWN

The GDP rose. My income fell.

GOOD IS UP, BAD IS DOWN

Things are looking up. Things are at an all time low.

RATIONAL IS UP, EMOTIONAL IS DOWN

He couldn’t rise above his emotions. The discussion fell to the emotional level, but I raised it back up to the rational plane.

Another metaphor their book highlights also runs deep in our culture:

TIME IS MONEY

You’re wasting my time.

I don’t have the time to give you.

I’ve invested a lot of time in her.

You’re running out of time.

Is it worth your while?

He’s living on borrowed time.

You need to budget your time.

Thank you for your time.

The Bible is as riddled with these metaphors as Christianity is with our culture. The great sociologist and political economist, Max Weber, claims Protestantism is at the root of capitalism in his book, The Protestant Ethic and the Spirit of Capitalism,

"In these cases the choice of occupation and future career has undoubtedly been determined by the distinct mental characteristics which have been instilled into them and indeed by the influence on them of the religious atmosphere of their locality and home background."

Here are some quotes from the bible that urge followers to work their butts off, or else.

Through laziness, the rafters sag; because of idle hands, the house leaks.

The diligent hand will rule, but laziness will lead to forced labor.

Fools fold their idle hands, leading them to ruin.

Here’s one from the King’s bible that lends insight into perhaps why the American workforce is overworked, has too few days off, and is led to shame should they loose their job.

How long will you lie there, O sluggard? When will you arise from your sleep? A little sleep, a little slumber, a little folding of the hands to rest, and poverty will come upon you like a robber, and want like an armed man. Proverbs 6:6

It may come as a surprise, but not every culture lives by these metaphors. The culture I was raised in certainly did. It’s also one that views the more innocuous concept of future as ahead, but another culture may view it as behind — or up, down, through, under, or over for that matter. Perhaps some cultures have no orientation metaphors at all, or use them differently than, say, the Bible does.

When these two researchers came together to write their book, they “discovered that [these] certain assumptions of contemporary philosophy and linguistics have been taken for granted…since the Greeks.”

Substantiating the role cultural metaphors play in shaping thought and action “meant rejecting the possibility of any objective or absolute truth.” Those absolutisms, including those found in the Bible, are assumed in so much of Western tradition and contemporary belief systems.

The alternative, as outlined in their book, is to suggest the human lived experience plays a more central role than some religious, mythical, or universally constant human objective truth.

Our current economic system relies heavily on a belief in rational choice theory. This idea, in keeping with the Western tradition Lakoff and Johnson sought to debunk, says that humans – also known among neoliberal economists as homo economicus – routinely conduct perfectly objective and absolute rational cost-benefit analysis before deciding how to spend money or accumulate wealth.

If what Lakoff and Johnson suggest is true, and I’m inclined to believe it is, there is no such thing as objective or absolute truth in decision making. Our decisions are guided by our culturally engrained metaphors. The so-called invisible hand that neoliberal economists turn to as a self-interested magical motivational source of individual wealth and prosperity is actually the invisible mind; a mind influenced by embedded conceptual metaphors that guide our emotions which in turn trigger our thoughts and actions.

IN EXCESS WILL END SUCCESS

Social psychologist, Jonathan Haidt, once said (and I’m paraphrasing) that if you want to find evidence of irrational behavior in self-reported rational people, study their entrenched dogmatic positions – it’s there you’ll find their irrational behavior. In our currently divided society, you don’t need to look far to see evidence of the myth of perfectly rational behavior in human decision making.

“Every society clings to a myth by which it lives. Ours is the myth of economic growth.” Those are the words of British ecological economist, Tim Jackson. To illustrate the myth, he offers that “People are persuaded to spend money we don't have, on things we don't need, to create impressions that won't last, on people we don't care about.”

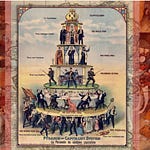

Aristotle observed as much in the 4th century and wrote about it in a set of eight books on the philosophy of human affairs called, Politics. He wrote,

“For, as their enjoyment is in excess, they seek an art which produces the excess of enjoyment; and, if they are not able to supply their pleasures by the art of getting wealth, they try other causes, using in turn every faculty in a manner contrary to nature…some men turn every quality or art into a means of getting wealth; this they conceive to be the end, and to the promotion of the end they think all things must contribute.”1

There are ongoing debates about what Aristotle would think of today’s economy.2 Both capitalists and communists draw on Aristotle as the genesis of their philosophies. But suffice it to say, Aristotle was not a fan of individual wealth accumulation. Any accumulation should be shared back to the society in support of a healthy community.

Some scholars believe Aristotle would say “the lending out of money to acquire more money is merely the most unnatural and corrupting way to employ money.”3 As corrupt, they claim, as using human sexuality to sell sex.

They believe Aristotle would not have made it a “question of the market value of your gold.” But instead, “what kind of man your gold makes of you.”

It also seems Aristotle would not have been very impressed with the damage we inflicted on the earth in our pursuit of wealth accumulation. He was aware of the negative aspects of “unintended consequences” due to human activity, but he also found them to be “generally bad and disappointing.”4 That, for sure, is a departure from our current neoliberal stance.

It was Adam Smith, the father of the capitalist economic system that dominates the world today, who said,

“[People are] led by an invisible hand to promote an end which was no part of [their] intention.”

By this logic, the plastics industry is led by an invisible hand to promote an end (for example, a path toward more plastic in the ocean than fish), which was no part of their intention. The oil industry is led by an invisible hand to promote an end (for example, climate collapse), but is not part of their intention. Even though they’ve known this for over 30 years.

The aerosol industry was led by an invisible hand to promote an end, a hole in the ozone, which was not part of their intention; but the world rallied to curb its use. The tobacco industry was led by an invisible hand to promote an end, addiction to a cancer causing drug, which was not part of their intention; but the U.S cracked down on them anyway.

British economist, John Maynard Keynes – an advocate of the free market, but also of instituting limits, put it best by issuing this sober warning,

“Capitalism is the extraordinary belief that the nastiest of men, for the nastiest of reasons, will somehow work for the benefit of us all.”

LEAKS AND PEAKS; GO WITH THE FLOW

Influential American economist Milton Friedman started to distance himself, and U.S. economic philosophy, from Keynesian ideas in the 70s. The country was in a recession and personal wealth accumulation had stagnated.

This American ideal of wealth accumulation began in American economics in the late 1940s after two world wars and a depression. Personal and national wealth accumulation was as much a need as it was a desire. It only follows that the model of economics we have with us today puts personal and corporate wealth accumulation at the center, above all else. (note the orientation metaphors I inadvertently used: follows, center, above all else!)

This economic model was drawn in a diagram by economist and Nobel prize winner, Paul Samuelson, for the canonical economic text book, Economics, in 1948. It has sold over four million copies and is still used by many schools today.

That book became standard issue for Econ 101 in universities across the country that were flooded with men returning from WWII. It’s a simple diagram that shows Circular Flows of money being exchanged between households and businesses.

Households flow labor into businesses which in turn crank out goods and services. Businesses flow wages to households that flow that money back to businesses through consumer spending on their goods and services.

There are also leakages in this central flow from households; savings leak into banks, taxes to the government, and imports to trade. These leaks are converted into value and flowed back to the business side as injections into the economy; investments flow from banks, spending from government, and exports from trade.

As economist Kate Raworth points out, missing from the diagram is the earth and the resources necessary to sustain this economic flow.5 But many advocates of this model believe resources are endless.

In the 1980’s University of Maryland business professor and neoliberal, Julian Simon, believed that

“Discoveries, like resources, may well be infinite: the more we discover, the more we are able to discover.”

He imagined competitive market prices would keep resources from being over exploited and novel inventions would efficiently reuse and recycle any wasted matter and energy. That doesn’t appear to be working.

Instead improvements in technology have accelerated the rate of extraction resulting in environmental degradation and collapse. Take the fishing industry. With improved sensing technologies, they’re able to fish small and sparsely populated schools of fish. It can lead to collapse and extinction.

What’s more, these small populations are vulnerable to effects of climate change which challenges both their survival and ability to repopulate. And sure enough, if they do recover, the fishing industry pounces and the cycle of over exploitation begins again.

Systems thinker, environmentalist and Dartmouth professor, Donella Meadows, states:

“Nonrenewable resources are stock-limited. The entire stock is available at once, and can be extracted at any rate. But since the stock is not renewed, the faster the extraction rate, the shorter the lifetime of the resource.”

In contrast,

“Renewable resources are flow-limited. They can support extraction or harvest indefinitely, but only at a finite flow rate equal to their regeneration rate. If they are extracted faster than they regenerate, they may eventually be driven below a critical threshold and become, for all practical purposes, nonrenewable.”

Indigenous cultures have known this for millennia. That’s why they leave harvestable crops behind. If they didn’t, they know there would not be any seeds for next season.

We have been led to believe, and our current economic systems substantiates, nonrenewable resources are limitless. We’re taught that even though our self-interest in accumulating wealth may come with unintended consequences, those negative effects are a matter of “value judgement.”

For example, valuing profit over the health of the planet and it’s occupants is a matter of judgement. It’s a line of thinking that values capitalism and corporate and individual wealth accumulation over all else – even the prospect of the collapse of entire species; including humans. Will capitalism seek to out live human existence? You be the judge.

We’re reminded every day that economic indicators can only go up because our culture evolved to associate up with good. If an economy can only be deemed good by a limitless line that goes up for eternity but relies on limited resources that require periods of flattening of that curve to be renewed, we need to extend the metaphor for good to include flat and even declining.

Up is good. Growth is good. And we don’t have time to waste. But even though the Bible tells us otherwise, we might want to sit down and take a breather sometimes and call it good.

My aging body reminds me, there are limits to up. I struggle with accepting this fact. Most do. It also shows there are exceptions to metaphors. Just because our age goes up, that doesn’t necessarily mean it feels good.

My body is a renewable resource but with a limited and declining life span. It can’t support the extraction of resources indefinitely, but it can maintain a finite flow of energy equal to my body’s, albeit declining, regeneration rate.

But if I push too hard and exploit my resources; and equate increased pullup reps or faster running speed with good, I’ll drive my resources below a critical threshold and they’ll become nonrenewable.

So now when I’m feeling up for a run. I don’t let myself get too depressed when my energy starts to fall. Instead of digging deep in a yearning for peak performance, I change my goal and shift my metaphor. I push that irrational ‘growth at all cost’ dogma to the side, bring the joy of a flat and slightly declining curve to the foreground, and feel my energy levels and my spirit rise.

You see, I have a rational mind after all. Aristotle believed our ability to reason with our feelings is what makes us human. It’s what sets us apart from other animals. I have a rational choice to make when presented with a curve that flattens out or declines. I can succumb to the cultural belief and emotion that a line that curves flat or trends down is always bad, or I can shift my thinking that it is sometimes good and even necessary for survival.

If I can do this with my fitness routine amidst a mid-life crisis, surely we can for an imbalanced economic regime amidst a climate crisis.

Aristotle's Difficult Relationship With Modern Economic Theory. Spencer J. Pack. Connecticut College. 2008.

Ibid.

Ibid.

Ibid.

Doughnut Economics: Seven Ways to Think Like a 21st-Century Economist. Kate Raworth. Random House. 2017.