Hello Interactors,

Last week we explored the role naturalists brought to a more open, flexible, and pragmatic approach to the Enlightenment. Today we expand on how our dominant economic ideology remains beholden to dogmatic, sterile, and abstract mathematical models the naturalists were trying to shake. One of the more popular figures in popularizing and perpetuating this pernicious economic perspective was Britain’s Prime Minister, Margaret Thatcher.

As interactors, you’re special individuals self-selected to be a part of an evolutionary journey. You’re also members of an attentive community so I welcome your participation.

Please leave your comments below or email me directly.

Now let’s go…

THE TINA SCHEMA

As British Prime Minister Margaret Thatcher was gaining traction with her hardline policies many of her conservative colleagues thought she was too harsh. In response she began calling them ‘wets’ which in Britain meant ‘inept, ineffectual, and effete’. She was famously proud of her resolute, often binary, moral convictions. In response to the economic disarray Britain was facing as she came to power, she said these words in a speech at a conservative women’s conference in 1980,

“There's no easy popularity in what we are proposing but it is fundamentally sound. Yet I believe people accept there's no real alternative…What's the alternative? To go on as we were before? All that leads to is higher spending. And that means more taxes, more borrowing, higher interest rates more inflation, more unemployment."1

The phrase “there is no alternative” became a refrain for Thatcher. It was used so often it prompted one the ‘wets’, Norman St John-Stevas, to abbreviate it forming a retaliatory derogatory name for Thatcher – TINA. He, and other ‘wets’, took to calling her ‘Tina’. He later wrote in a book that Thatcher saw "everything in black and white [but] the universe I inhabit is made up of many shades of grey".

I suspect Thatcher was confident in her resoluteness because the neoclassical economists she relied on, both in the UK and the US, were themselves certain there was no alternative. Their confidence was, and still is, buoyed by the certainty that can come with the mathematics behind their economic models. But that certainty can be an illusion that can lead to delusion.

Education researcher, Don Ambrose, says it can start early in math education and over time this “dogmatic thinking can trap professionals, policymakers, and others into perceiving only the sterile certainty of the surface of mathematics while remaining oblivious to its messy, creative inner workings.”

He continues,

“While mathematics provides us with a considerable amount of analytic precision it still is at least somewhat susceptible to the vagaries of the human mind and open to impressive creativity.”2

He quotes the prominent economist Thomas Piketty who in his 2014 book, Capital in the Twenty-First Century, saying,

“For far too long economists have sought to define themselves in terms of their supposedly scientific methods. In fact, those methods rely on an immoderate use of mathematical models, which are frequently no more than an excuse for occupying the terrain and masking the vacuity of the content.”3

He says it can create a ‘scientific illusion’ that ignores the messy realities that, again, Adam Smith viewed as essential to a healthy economy; a shared cultural understanding, a socially just labor market, and a trustworthy government.

But even some mathematicians agree mathematics can lead one astray. The mathematician William Byers, who researches dynamical systems and the philosophy of mathematics, writes,

“What we usually call mathematics—results, proofs, and structure—is the unambiguous face of the subject…[But] looking at mathematics as a human activity, as mind-dependent, forces one to confront the ambiguous dimension of math.”4

These are the very ‘shades of grey’ the ‘wet’ set Tory’s unsuccessfully settled with Margaret ‘Tina’ Thatcher. And the man Thatcher liked to blame for the economic mess she inherited was someone who would have agreed with the uncertainty these ‘wets’ were pointing to – Britain’s most famous 20th century economist, John Maynard Keynes.

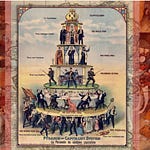

Keynes made a name for himself in the 1930s devising economic policies that proved to ease the effects of the depression that had wracked the world. His ideas were counter to neoclassical ideas, and those later championed by Thatcher. He believed, like Adam Smith, that markets should include some governmental intervention to minimize the adverse effects of recessions and depressions.

Every capitalistic government in the world had instituted his policies until the 1950s, soon after he passed away. From that point until now, the neoclassical ideology of America’s most famous 20th century economist, Milton Friedman, reigns supreme. A philosophy that promotes free-wheeling, free-trade, and free markets that are free of government restraint, and are backed by rigid and sterile mathematical and statistical models.

Keynes was no stranger to mathematics; he was awarded a scholarship to study it at Cambridge. But he did believe that it was being dogmatized, misused, and misconstrued to bolster the legitimacy of economics by wrapping it in perceived certainty, logic, and accuracy. So much so, it led people to believe there is no alternative.

In Keynes’s 1936 groundbreaking book The General Theory of Employment, Interest and Money, he asserts this as his criticism of neoclassical economics.

“our criticism of the accepted classical theory of economics has consisted not so much in finding logical flaws in its analysis as in pointing out that its tacit assumptions are seldom or never satisfied, with the result that it cannot solve the economic problems of the actual world.

THE NEWTONIAN BABYLONIAN

Keynes’s General Theory was to generalize existing neoclassical theories and methods. In other words, marry the ‘shades of grey’ of the real world with existing mathematical methods and analysis. He was particularly focused, as much economic work is, on being able to predict economic outcomes in the future. A future that is uncertain. And with that, Keynes called for “at least a partial attempt to incorporate the fact of uncertainty into an economic theory.”

He believed this required an approach that embraced the uncertainties of the real world as clues or observed evidence that could then be scrutinized with analysis, reason, and mathematics. One person he believed personified this approach was a man he idled, Isaac Newton. His thoughts were captured in a lecture he wrote to celebrate the life of Isaac Newton in 1946 but was unable to deliver. He died three months before the event.

He wrote,

“Newton was not the first of the age of reason. He was the last of the magicians, the last of the Babylonians and Sumerians…Why do I call him a magician? Because he looked on the whole universe and all that is in it as a riddle, as a secret which could be read by applying pure thought to certain evidence, certain mystic clues which God had laid about the world to allow a sort of philosopher's treasure hunt...”5

Some scholars have latched onto Keynes use of the word ‘Babylonians’. This term is associated with an ongoing controversy in academia about two logical approaches to the social sciences. Finance, economics, and philosophy professor, Mark Stoh, characterizes it like this:

“There are two basic approaches. The first, the Cartesian-Euclidian approach, is ‘the familiar axiomatic one in which the fundamental principles of a science are taken as axioms, from which the rest are derived as theorems.’ Because it comes closest of all the social sciences to attaining this axiomatic ideal, economics has occasionally been considered to be the queen of the social sciences. The second approach is the Babylonian. According to it, there is no single logical chain from axioms to theorems; but there are several parallel, intertwined, and mutually reinforcing sets of chains, such that no particular axiom is logically basic.”

In this context, Keynes views on uncertainty fall more in line with the Babylonians. Further, Keynes characterizes Newton as using methods of inquiry that date back to the ancient times of the Babylonians. Because the mathematics and economics of Babylonian times were captured in stone and since translated, we know a great deal about how they solved mundane and complex problems. Many scholars believe they used pragmatic problem solving that embraced uncertainty and holistic approaches of various mathematical constructs.

Another famous great mind of the 20th century concurs, the renowned physicist Richard Feynman. In a 1965 lecture he talks about the distinction between what he called ‘Babylonian’ and ‘Greek’ approaches to mathematical problem solving. He asserts students learning math in these times were taught different techniques for calculating various mathematical problems. They were then given practical problems whereby they had to determine which techniques were to be linked in a chain to solve a particular problem.

Feynman describes it as a constellation of techniques that could be linked together in a variety of ways to arrive at an answer. For example, the equivalent of the Pythagorean theorem could be linked to calculating the volume of a cube. It was a holistic approach to pragmatic problem solving given the context of the situation at hand, even if the situation were to change.

What Descartes came along and did was reduce the common elements of these constellations to form a set of ordered axioms. Mathematics was then taught from the bottom up as ordered steps, each layer of the constellation building on itself to form theorems. Mathematical problem solving was then taught as ordered and deterministic with no regard for how one might leap from one technique to another should the conditions of the problem set change.

Feynman says,

“the method of starting from [the bottom] axioms is not efficient in obtaining the theorems…Working something out in geometry is not very efficient if you always have to start at the axioms, but if you had to remember a few things in [the constellation] of geometry you can always get somewhere else [in the constellation] which is much more efficient than if you do it the other way.”6

Feynman believed solving problems in physics requires a Babylonian approach due to the changing nature of the natural physical world. This is in contrast with pure mathematics, as derived by Descartes and Euclid, that yields universally consistent solutions within the context of an abstracted world.

OPEN TO ALTERNATIVE SYSTEMS

In the context of economics, British economist Sheila Dow offers that in a constellation of economic mathematical tools “One chain of reasoning might rely on statistical analysis, while another might rely on historical research, for example.” Dow is a Post-Keynesian economist who expands on the work of Stoh and Feynman in her paper on the “Babylonian Mode of Thought”.

Dow expresses ‘Mode of thought’ as “the way in which arguments (or theories) are constructed and presented, how we attempt to convince others of the validity or truth of our arguments.” Her interpretation of Keynes reflection on Newton was that he “relied on intuition in order to arrive at explanations for natural phenomena, on the one hand, with the rational proofs he constructed after the fact, on the other.”

This was his ‘mode of thought’, she argues, that enabled him to make the discoveries he did. And like Feynman, she implores others to learn and apply this more ‘Babylonian’ approach to solving complex problems. That is, a pragmatic and wholistic approach through the practical application of an array of mathematical methods which are traversed over time as situations, contexts, and variables change.

Dow equates the Babylonian approach with an open system – a system of infinite unknown variables that change in relation and response to each other, and the environment in which they exist, over time. This is contrast to a closed system where all the variables, their interactions, and relationships are known and isolated in the environment in which they exist. Closed systems are divided into dual atomic parts, the internal, or endogenous, and the external, or exogenous.

Dow believes,

“Babylonian thought is neither dualistic nor atomistic. The categories used to account for social life in an evolving environment are not seen as readily falling into duals. Indeed vagueness of categories is seen to have the benefit of adaptability within a changing environment where institutions, understanding and behaviour undergo change. In a system of thought with a variety of incommensurate strands of argument, variables may be exogenous to one strand but endogenous to another.

Knowledge is in general held with uncertainty (by economic agents and by economists), so the analysis points to degrees of uncertainty. Further, some strands of argument may refer to individuals, and others to the group level, since causal forces may act in either direction. Indeed individuals are not seen as independent, and their behaviour may change as the environment changes.”7

She continues,

“Similarly, Babylonian thought provides a rationale for pluralism. It justifies both methodological pluralism (methodologists analysing a range of methodologies) and pluralism of method (economists using a range of methods).”8

Dow then warns that many who subscribe to conventional economic approaches, or Cartesian modes of thought, sometimes claim that ‘pluralism’ is just an excuse for sloppiness leading to an ‘anything goes’ approach and attitude. But she argues, as Feynman illustrates, that

“Babylonian mode of thought requires some criteria by which to choose segmentations of the subject matter for analysis, the chains of reasoning to pursue, and the methods employed to pursue them.”

In this regard, not only is there is a high degree of mastery of various methods required, but that their application is highly structured. This leads her to claim Babylonian modes of thought are not ‘pure pluralism’, but ‘structured pluralism.’ She adds, as did Feynman, this may require not only traversing within the domain of mathematics, economics, or in the case of Feynman, physics, but also into other domains of science and humanities.

Sorry ‘Tina’, in the pursuit of answers in complex, uncertain, and changing environments it seems alternatives are not only desirable, but necessary. Those alternatives, however, have yet to be pursued despite record income inequality. After Thatcher came John Major who, despite being responsible for a raft of immoral behavior known as ‘Tory sleaze’, was part of Britain’s longest running economic prosperity.

He was replaced in 1997 by the opposition Labour Party candidate Tony Blair. Three years into his term Thatcher was asked what she thought her greatest accomplishment was. She replied, “Tony Blair and New Labour" because he, like U.S. Democratic President Bill Clinton, adopted most of her policies. She said she "forced [her] opponents to change their minds."

The irony of the Iron Lady, and all those who cling to the belief there is no economic policy alternative, is that the illusion of certainty represented by neoclassical and Cartesian closed systems has created more social and environmental uncertainty than ever. We live in organic, ever changing open system in uncertain times, in an uncertain world. If ever there’s a time for an alternative, it seems it would be now. It’s time we change our ‘mode of thought’ and convince others that the pragmatic and wholistic Babylonian approach is a viable alternative. Let’s turn ‘TINA’ into ‘TAMA’ – There are many alternatives.

There is no alternative. Wikipedia.

Ibid

Ibid

Newton, the Man. John Maynard Keynes. 1946.

Feynman: 'Greek' versus 'Babylonian' mathematics. Richard Feynman. 1965.

Babylonian Mode of Thought. Sheila Dow. 2012.

Ibid