Hello Interactors,

This is the last full week of fall and so the last episode on economic geography. Happy early winter solstice everyone. Soon we in the North start tilting toward the sun. I’ve learned a ton this season and hope you have too. Today I conclude with a summarization of the history and effects of capitalism as we know it today and offer a glimpse at alternatives. We like easy answers to hard problems, but I’m here to tell you it’s messy and complex. And that’s just the good stuff.

As interactors, you’re special individuals self-selected to be a part of an evolutionary journey. You’re also members of an attentive community so I welcome your participation.

Please leave your comments below or email me directly.

Now let’s go…

THE URGENCY OF CRYPTOCURRENCY

Cryptocurrency was trending as a topic again this fall. It spiked in October. I still see residual evidence of this in my social media feeds where debates rage on over whether it’s a legitimate form of currency or just a speculator’s delight.

Cryptocurrency was invented to circumvent the juggernaut that banks, governments, and credit card companies hold on the currency market. But the more it gets legitimized as an alternative currency, the more interested these traditional institutions become. For example, one form of cryptocurrency rising in popularity are stablecoins. It’s a digital currency that can be converted into ‘real’ money and is issued by the very institutions the inventors were hoping to circumvent. It seems there is no escaping Western economic dominance.

Money in the U.S. is commonly believed to come from the government, but most greenbacks issued today come from banks. They order currency from the Federal Reserve based on public demand which is then put into general circulation – which is growing worldwide. In fact, there are more U.S. dollars circulating outside of the U.S. than in it. Much of which is used by people struggling financially around the globe.

Meanwhile, those not struggling are using cash less and less. Recently, some New York retailers even attempted to go cashless. It prompted the city to pass a law requiring food establishments to accept cash or face a $1,000 fine.

Still, increasingly we see people paying for items with their phone. In this digital, post-cash society it’s easy to imagine an alternative virtual currency sneaking in. If our democracy can be challenged, why not our currency? A recent New York Times article by Peter Coy on the slipping grip of cash notes that “Some economists believe there is a risk that we’ll someday find ourselves with nothing that is universally accepted as a medium of exchange.” He goes on to remind us that is was Socrates who “originated the concept of a noble lie, which is a myth that elites propagate for what they view as the good of the public.” He then quotes Michael Dorf of the Cornell Law School who believes “the solidity of money is one such lie.”

The truth is, alternative currencies and economies exist all around us and have for centuries. For example, in a district of central London call Brixton, where David Bowie once lived, shops no longer accept the British Pound. Instead they take an alternative currency called the Brixton Pound that features a picture of Bowie on a paper bill that is as nicely designed and proportioned as Bowie himself.

It’s been in circulation since 2009 and 250 area shops accept it. Workers in Brixton also get paid with it and you can even settle your utility bills with it. It’s a hyper-local monetary scheme that incentivizes local residents to shop local, buy local, and live local. The Brixton Pound has inspired cities across the UK to do the same and now Bristol, Cardiff, Hull, Liverpool, and Plymouth all have their own alternative local currencies.

Many schemes like this exist outside of the Western world too – and they’re often not tied to the dominant currency system. For example, there’s a settlement on the outskirts of Nairobi, Kenya called Bangladesh. Not to be confused with the country of Bangladesh. It was named after an early settler who unexpectedly packed up and moved to Bangladesh never to return. The area was hence called Bangladesh. It’s a poor informal settlement made of self-made homes and little to no infrastructure, yet is home to over 20,000 people. They work at nearby industries at the fringe of Nairobi doing odd jobs regularly paid workers refuse to do.

Many are well educated, but work is intermittent and there are more qualified workers than there are jobs. It leads to extreme poverty, apathy, and strife. One local teacher in the Peace Corps, Will Ruddick, became frustrated that he was graduating kids with no where to go. He said many of whom were more skilled academically than many he’d witnessed at Stanford. Ruddick happens to also have a PhD in econophysics – a branch of economics that draws inspiration from the field of physics. He began wondering how he could devise a way for residents in areas like Bangladesh to earn consistent wages doing meaningful work in their community. He wanted ways for them to create and share in their abundance, take charge of their own livelihoods, and build a self-sustaining economic future.

So in 2010 he launched an alternative local currency experiment called Eco-Pesa in three informal settlements in Kenya. That experiment became permanent in Bangladesh with the creation of their own currency; the Bangla-Pesa. Unlike the Brixton Pound, this alternative currency can’t be exchanged for the national Kenyan currency. It’s a closed system of money creation that serves one purpose: support a shared willingness among community members to accept and trade money in exchange for goods and services.

It has over 2000 members and 220 businesses and has helped fill the settlement with money, eliminate market instability brought on by outside nationalistic forces, provide opportunities for investment, and grow Bangladesh businesses that generate jobs.

He went on to found Grass Roots Economics which is a resource and platform that supports and inspires experiments like his. The platform has launched seven different forms of local currency in poverty stricken informal settlements across Africa, including two in South Africa and one in Congo. Last year the Red Cross leveraged the organization to establish more local currencies during Covid helping to grow the number of registered users of local currencies to over 50,000 people. Ruddick sees no reason why it can’t continue to scale regionally and even nationally. Maybe even across the second largest continent in the world. And he has the track record and models to substantiate his claim.

GREAT DIVIDE; WHITE PRIDE

The primary obstacle to such schemes taking hold too pervasively is the default global capitalocentric economic system of the West; a scheme that relies on places like Bangladesh to perpetuate its dominance. It’s a form of power and control that has existed since the spread of European colonialism starting in the 1400s.

Europe had yet to be introduced to capitalism. Which means, contrary to popular belief, they didn’t invent it. There’s now ample research pointing to evidence of capitalist trade and profit already occurring across Africa, Asia, and the Americas.1 Folks like Christopher Columbus would have tripped over these capitalist trade routes as he stumbled his way upon their shores. In fact, it’s more likely European colonial scouts like Columbus were in the untenable position of trying to convince these well established economies that they should allow lowly Europeans to even participate in their capitalistic schemes.

The Ming dynasty in China and the Mughal Empire of South Asia would have been two of the more established world centers of economics at the time. Medieval Europe, in comparison, would have looked primitive and backwards by their standards. But over the course of centuries, the Europeans managed to disrupt (often violently) existing capital structures creating what has been called the Great Divergence – a socioeconomic shift in balance to the West.

Just how ‘great’ it was is a matter of perspective, of course. To Amer-Europeans it was great. I certainly grew up learning that. I was taught Europeans were fortunate geographically, gifted intellectually, and superior culturally. Their ‘enlightened’ selves rose above the paltry ills of feudal medievalism to erase an embarrassing historical stain. Their inventiveness gave rise to free and fair democracy and capitalism that eventually spread from America’s sea to shining sea. Not so fast.

A new book by Anthropologists David Graeber and David Wengrow show compelling evidence that it was actually a visit from the Native American (Huron-Wendat) statesman, Kandiaronk, who planted the seeds of ‘enlightenment’ with European philosophers in his eloquent and observant criticism of European ways. Here is a fragment of a speech he delivered to a group of French philosophers and statesmen in 1703:

“I have spent six years reflecting on the state of European society and I still can’t think of a single way they act that’s not inhuman, and I genuinely think this can only be the case, as long as you stick to your distinctions of ‘mine’ and ‘thine’. I affirm that what you call money is the devil of devils; the tyrant of the French, the source of all evils; the bane of souls and slaughterhouse of the living. To imagine one can live in the country of money and preserve one’s soul is like imagining one could preserve one’s life at the bottom of a lake. Money is the father of luxury, lasciviousness, intrigues, trickery, lies, betrayal, insincerity, – of all the world’s worst behaviour. Fathers sell their children, husbands their wives, wives betray their husbands, brothers kill each other, friends are false, and all because of money. In the light of all this, tell me that we Wendat are not right in refusing to touch, or so much as to look at silver?”2

The heart of Kondiaronk’s critique is what fueled the ‘great divergence.’ Their ‘slaughterhouse of the living’ is what disrupted existing Asian economic dominance. It wasn’t ‘enlightenment’ but well documented, practiced, and executed forms of slavery, racism, and war-instigated establishment of European controlled capitalism. They re-centered economic activity around themselves through force, but convinced themselves, and others to this day, that their actions were justified. The British and American economic geography professor, Eric Sheppard, from UCLA puts it like this:

“The stories Europeans told themselves, and imposed on others, amounted to a self justification of their role as a uniquely civilizing force, marginalizing the colonized (from Ireland to India and the Belgian Congo) as less-than-civilized, in order to justify their less than-human treatment by self-described liberals.”3

In the late 1800s, after the U.S. slaughtered 3,000 Filipinos as part of an overnight raid in the colonization of their land, America’s favorite poet at the time, Rudyard Kipling, wrote a poem that emblemizes the racist, violent, and self-justified imperialistic sentiment of the time:

Take up the White Man’s burden—

Send forth the best ye breed—

Go bind your sons to exile

To serve your captives’ need;

To wait in heavy harness,

On fluttered folk and wild—

Your new-caught, sullen peoples,

Half-devil and half-child.4

It was published in the New York Tribune, New York Sun, and San Francisco Examiner. It was also loved by President Theodore Roosevelt who sent a copy of it to his close friend and Massachusetts politician, Henry Lodge, with a note that read:

“Rather poor poetry, but good sense from the expansion point of view.”

Capitalism is rooted in racism and its emergence was tied to the colonization of captured territories over seas through militaristic invasions. By the time Roosevelt was putting it in practice in the U.S., it was a centuries old well-oiled machine. The rights of European territories to claim sovereignty and organize captured territories first emerged in Europe after the signing of the Treaty of Westfalia in 1648. After 80 years of European territorial and religious wars, this peace treaty forced the Holy Roman Empire to divvy out sovereign states (countries) across Europe and allowed them to also choose their own official religions.

This event coincided with the emergence of political economists in Scotland, England, and France who had been debating and writing socioeconomic theories for years. Especially after the visit from Kondiaronk. They seized the opportunity to imbue their concepts with a secular vision that allowed capitalism to thrive between diverse European countries, and religions, for their mutual benefit. One such economic theory to eventually emerge was Adam Smith’s ‘invisible hand.’

With a European model of economic abstraction established, it was then tied to government controlled nation-state territories. It was a no-brainer to replicate this model for any remote territory conquered, bartered, and stolen overseas. And just like that, global colonization had taken hold. The emergence of the great divergence.

It is from this confluence of events that the Western educated world has come to believe capitalism as conceived in the minds of Enlightened European thinkers. And because they self-justified themselves as intellectually and spiritually superior to other races and religions, including Kondiaronk, they believed, and we’ve been taught, that the European colonial and capitalistic expansion was for the good of humanity.

But let’s be honest, this is fantasy. And it’s dangerous to abstract away capitalism from the real and documented horrors of racism, slavery, rape, persecution, theft, exploitation, and extermination that allows it to flourish to this day. It shouldn’t be sanitized as a ‘great divergence.’ It should be chastised as a hate insurgence.

With the rise of Trumpism we are witnessing the sheen of capitalist oriented racism shining through decades of opaque but fading layers of failed attempts and promises of liberty and justice for all. And it’s in the spirit of domineering nationalists taking up Kipling’s distant, but misguided, call to accept the ‘White Man’s burden.’ And how much better is the Biden administration when kids captured at the border under Trump still remain in cages like ‘new-caught, sullen peoples, half-devil and half-child.’ In the words of Kondiaronk, “the world’s worst behaviour.”

Both the left and the right, who are still smarting from Covid supply chain woes and wringing their hands over increasing inflation, are both viewing the global economic juggernaut their parties helped to construct with suspect for the first time. They’re not alone. Every country in the world is scrambling to reconsider their local economy as it relates to Western capitalistic global domination. No wonder the world is suffering a collective anxiety attack.

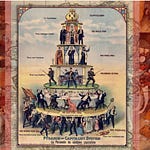

DON’T CRINGE AT THE FRINGE

We are witnessing an array of identity crisis across the socio-political spectrum. From far right nationalistic white-supremacy authoritarianism to the far left hopes of reconstituting socialist theories of idealized utopias. Both of which are different forms of top-down autocratic attempts at organizing social order and economies – one through neoliberal capitalistic oligarchies and the other through socialistic governmental central control. And because our poor human brains are attracted to binary polars, seek simple answers, and loath the messy middle, we suffer.

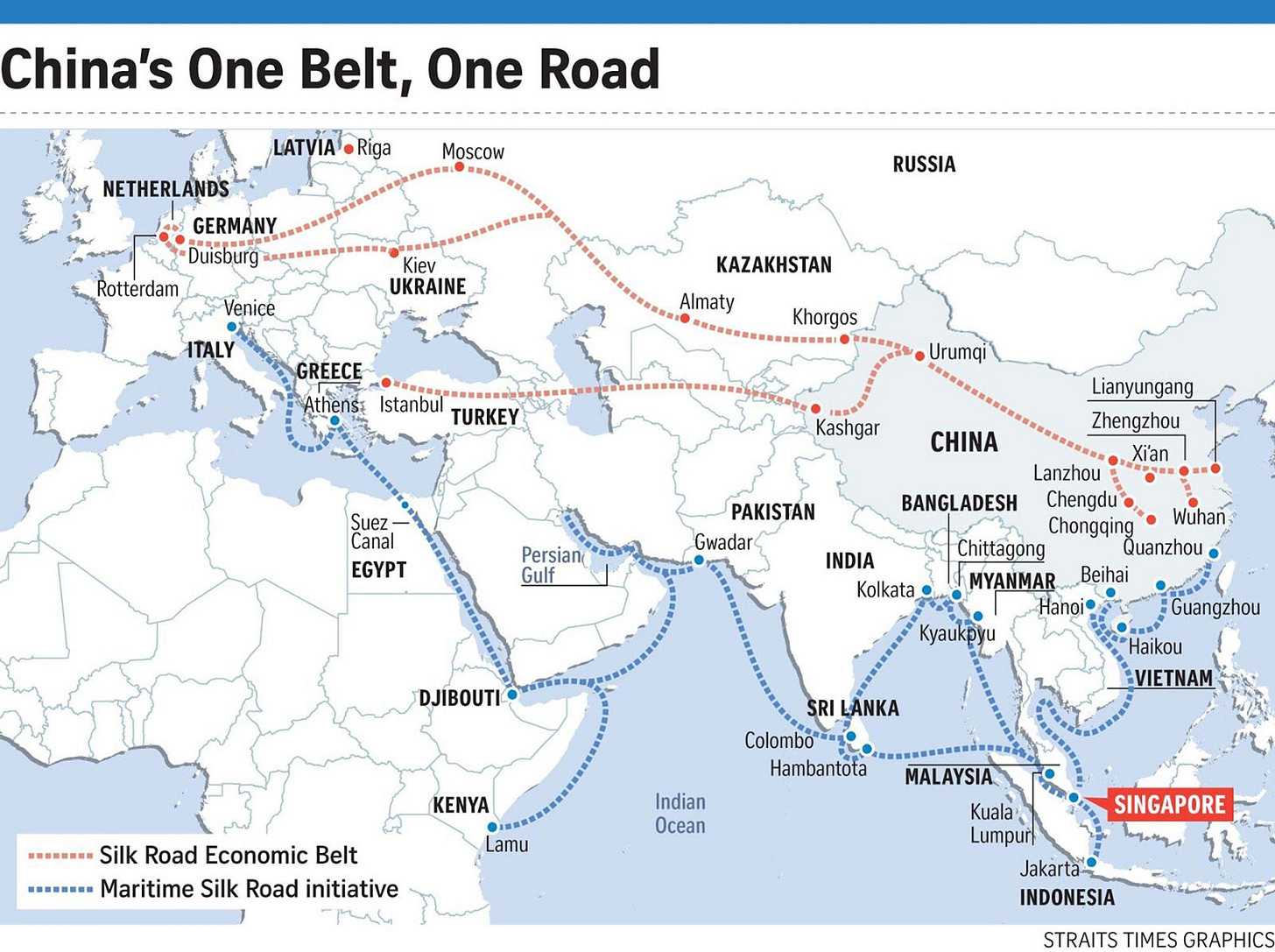

Meanwhile, fringe experiments in alternative economic schemes continue to flourish as they always have. But some encroach on the establishment more than others. And one in particular operates at a scale big enough to challenge the West’s strangle hold on global economics – China. China’s global Belt and Road Initiative, while China-centric, is also undeniably globally inclusive.

They have been dispersing their investments in infrastructure and commodity creation and extraction in a myriad of countries – big and small, rich and poor – around the world since 2013. At home they operate a hybrid Socialist and Capitalist government that then orchestrates attempts at controlling a global economy. If a hybridist socioeconomic experiment is seriously challenging the default world economy of the last 50-60 years, shouldn’t the U.S. and Europe consider conducting experiments of their own? Or has hubris and denial taken too strong of a hold? Only history will tell.

It’s safe to say that the days of claiming Western style capitalism and U.S. exceptionalism have been exposed and debunked. Adam Smith’s “invisible hand” has come into the light and it’s empty. And the neoliberal free market economy is anything but free and has financially imprisoned millions for decades. Also gone are the Eurocentric interpretations of history. It’s time we stop insisting that the capitalistic scheme dominating the world today, while not perfect, is the least-bad option and therefore every country must adopt it. It’s rhetoric like this that the global North uses to twist the arms of the poorer global South to align them with their socio-political and economic agenda.

Our beloved binary brains, again, are attracted to global North versus global South battles of theories and victories. The same can be said of East versus West. But most countries caught in this polarization have their own theories, some invented, and some borrowed or influenced – good or bad – by centuries of globalization, education, and financing from the global North. It’s no fun, but we need to wrestle with the messy middle.

We in the West are so trained to assess and judge other geographies, cultures, and economies from our ivory towers of exceptionalism – as if surveying a globe from a godly perch – labeling, cataloging, and objectifying human and non-human entities, that we forget the interaction of people and place. As the late great economist, Herb Simon, says, (as illustrated on my about page)

Those folks in Kenya stand at the fringe of a global economic system that either ignores them, exploits them, or starves them to death. It’s what it means to be marginalized. But with the help of a friend, they are discovering their plight is largely a reflection of the complexity of the environment in which they find themselves. They have found a way to stand up, recognize and accept the apparent complexity, and act out of respect for each other’s position relative to one another…and the selfish globalized economic apparatus that put them there.

Professor Sheppard concludes that he and his Western educated colleagues, “suffer from a particular set of geographical blinders.” He says, “they look at our world in ways that normalize the European perspective on how development happens.” It’s a perspective he’s critical of because it’s a model of economic geography that “fails to deliver on its promise of development for all, everywhere.”

He goes on to offer that because Western style capitalism relies on “uneven and asymmetric connectivities” that end up “driving uneven geographical development”, we’ve arrived at a place where the dominant global economic scheme of globalization has failed “at scales ranging from the globe to the neighbourhood.”

To help combat his own implicit bias, he planted himself in Jakarta to do his research. “Thinking through Jakarta”, he says, “the raggedy fringes that matter are the hybridity of Indonesia’s political economy, informality and biophysical processes.” Instead of hypothesizing over concepts or proselytizing projects from the canons of capitalism, he’s asking that we recognize, as those in Bangladesh and Brixton did, that “relations with Capitalism are crucial to understanding how” emerging alternative economies embedded on the insides of dominant systems “coevolves with its outsides.”

Instead of propagating or placating a dominant global economy, what if we acknowledge, embrace, fertilize, understand, celebrate, and experience alternative economies embedded within or on the fringe of the establishment. After all, these are economies that have been forged through the interaction of people and place whose shared histories have, as Sheppard says, “found them encountering, rather than propagating, Capitalist economic development.”

Cryptocurrency is likely to trend again. Our anxiety has us looking for easy answers and social media likes shiny technocratic objects. Meanwhile, I’m rooting for Will Ruddick and his grass roots economies. A humane form of reciprocity that even the brilliant, eloquent, and enlightened Kondiaronk would recognize. And maybe even support.

Eric Sheppard. Globalizing capitalism’s raggedy fringes: thinking through Jakarta. Area Development and Policy. 2018

David Graeber, David Wengrow. The Dawn of Everything: A New History of Humanity. 2021

Sheppard. 2018.

Stephen Kinzer. The True Flag: Theodore Roosevelt, Mark Twain, and the Birth of American Empire. 2017