Hello Interactors,

The field of economics is stuck in the past. They need to move on, and they need to do it fast. Stop standing around, get in on the bustle. MOVE, MOVE, MOVE! HUSTLE, HUSTLE, HUSTLE!

As interactors, you’re special individuals self-selected to be a part of an evolutionary journey. You’re also members of an attentive community so I welcome your participation.

Please leave your comments below or email me directly.

Now let’s go…

BE ON THE VERGE TO SURGE

I recently attended my first full length high school basketball game. The last time I saw a high school game I was playing in one. Not much has changed in thirty-seven years. But I did notice more standing around than when I was playing. Watch any NBA game these days and you see a lot of standing around. Maybe these stagnate high school players are just trying to be cool.

When you stand in one place on the court, there’s little interaction with your teammates, the player guarding you, the ball, or the floor. It easy to predict what’s going to happen. Not much. My coaches always told me to move without the ball. Later in life, when I played in adult leagues, I found myself yelling to my teammates, “MOVE WITHOUT THE BALL, MOVE WITHOUT THE BALL.” I didn’t like games where guys just ran to the corner and stood there waiting for the ball or for someone to shoot. Bor-ing.

Moving around the court without the ball brings dynamism to the game. It increases the chances of interacting with your teammates, your competition, and the ball – across various parts of the court. Coaches design plays expressly to move players around the floor in coordinated orchestration just to get players open. Only then can they interact with the ball and hopefully score.

But plays quickly break down and improvisation ensues. It’s what I love about playing and watching basketball. When players are dynamic, new situations and interactions continually emerge and they’re constantly different. But then when a player gets the ball, the attention, interaction, and players converge on that one person. And as soon as they pass the ball or shoot it, everything diverges again. These split-second cycles of emergence, convergence, and divergence are continually in motion and each intentional or random action from any player, the ball, or even the referee or crowd, can send the cycle spinning in another trajectory.

Participating in this continual transformation of conditions yields a constant flow of new sensory inputs. They serve as raw material for the brain to invent new and novel interactions. The creative capacity of any player to introduce novelty based on their knowledge of the rules, the split-second state of players interactions, the location of the ball, the time on the clock, and hundreds of other sights, sounds, touches, and smells is what makes basketball work. It’s a continual flow of interactions with people and place that is constantly evolving based on adaptations to ever-changing novel situations.

Here are three examples of different layers of interaction happening in a game of basketball. While elements within a layer interact with each other, elements between layers do too.

One is happening between the players and the structure of the game. Any one player has the potential to have influence in the game, but they also have the choice to do so. And they can’t do just anything, there are rules to the game and certain social constructs that influence their behavior.

Another is happening at a locational level; in the painted rectangle under the basket, inside and outside the three-point line, half-court, and full-court – even out of bounds or at the circles for jump balls. There’s also home court versus away within a conference, advancing post-season to play teams in a district, or even, if you’re lucky, to play distance teams in a state tournament. My sister was lucky enough to do that. She sunk a last second jumper from the sideline to win the Iowa girl’s state tournament in 1981.

A third layer are the social and interpersonal interactions and transactions that occur between competitors, coaches and their players, and between referees, coaches and bench officials. These interactions also have a spatial component. Casual banter between a player and a referee under the basket during a free-throw takes on a different timbre than a referee angerly signaling a technical foul in the face of an out of control coach on the sidelines.

And then there are the physics of the game. In high school a math nerd friend of mine and I would try to determine the equation for the parabola of our jump shots. “You need to adjust your slope to be more like -.07 if you’re going to shoot 14 feet from the hoop.”, we’d joke. Through years of practice, professional shooters like Steph Curry can dial in each variable of a jump shot, including velocity and spin, to achieve the perfect 48-degree angle needed for a swoosh.

Dribbling a basketball up and down is predictable because physics is predictable. Hold a basketball in your hand and it possesses potential energy. Rotate your hand and gravity pulls the ball to the earth. When it hits the floor, potential energy converts to kinetic energy. As the ball returns to the hand kinetic energy transforms back to potential energy. Repeat. You can even do it while running – which involves yet more physics like acceleration and velocity.

These tangible and physical aspects of the game, while mathematically decipherable and predictable, are also intuitive. A kid can learn to dribble or shoot a Nerf ball into a hoop at age two. We marvel at players who can do physical feats well not only because we know how hard they are, but because they’re easy to understand. They’re rooted in physics that can be observed and measured. And in the case of free throws, where other variables influencing the outcome of the shot are minimized, statisticians can even calculate the probability of the ball going in based on known physics and the player’s historical record of free throw shooting. My sister shot 72% from the free throw line. Impressive.

LET’S GET PHYISICAL; IT’S COMPLEX

Physics is what inspired the field of economics.

Physics was the most respected science in academia and society at the time, so economists legitimized their social science by drawing associations to physics. They borrowed language from physics and built clean, rational mathematical models to communicate their ideas. It gives the illusion economics is as predictable as physics, but it turns out not to be true. And most of them know it, but it doesn’t keep them from perpetuating the myth.

While it’s officially now basketball season in the U.S., it’s also nearing the end of the year. That means more basketball to watch, but it also means more prognosticators making predictions for 2022. Including financial predictions. And just like basketball, economists and journalists focus on what’s most intuitive and calculable. The easy stuff rooted in static statistics.

A recent New York Times article talks about how Covid has demonstrated the difficulty of predicting the future, yet Wall Street analysts can’t help it. They’re already trying to predict the state of the economy a year from now. As the article says, “It’s time again for analysts to gaze into their crystal balls.” Even the analysts have trouble taking themselves seriously.

Here’s how the head of research at one global bank, BNP Paribas, puts it, “’The numbers are meaningless in a sense,’ he said, and continued with an engaging smile, ‘Whenever I make a forecast, and I have done this for a number of years, I know it is going to be wrong.’ But, he added, “The numbers are an illustration of where things are going; And they provide grounding, he said, to ‘have a thematic discussion with our clients.’”

You’d think their clients would have clued in by now. Last year Wall Street predicted 2021 would end with the S&P 500 at 3,800. They were off by 20%. Even after taking a hit from the Omicron scare last week, it was hovering around 4,500.

These people are using the same general techniques for predicting a global financial market as those predicting whether an NBA star will make their next free throw or win their next game. And they do it knowing full well there are infinite variables and inherent complexity in the myriad of interactions in a global economy. It would be like a sports analyst predicting who will win the NBA championship and by how much at the start of the season. Some still try, but they, and we, all know it’s a lark. Yet, when it comes to making financial forecasts, most mainstream economists (and universities) lead us to believe their methods are sound and that the economy is as predictable as physics. It’s not.

That’s not to say predictions of complex phenomena are worthless. People around the world rely on weather forecasts to plan their day and their businesses. Predictions have improved greatly over the years thanks to better technology and modeling, but also because meteorology, a branch of geography, knows they’re dealing with a complex system. They recognize, as do their models, that it’s more complex, for example, than just physics and that a successful prediction requires knowledge of the initial conditions of a storm. Which is literally unknowable. So they start with what they know, observe and understand the interactions, and update their model. Mainstream economists have yet to even admit they’re dealing with a complex system, let alone how to identify and verify initial conditions of catastrophic economic events.

The weather, the economy, and basketball are all complex systems. Weather is a natural system and economics and basketball are social systems. While they operate at vastly different scales and don’t share all the same attributes, they still have much in common.

One defining attribute is that complex systems are comprised of non-linear interactions between its parts – like elements of those layers of interaction I described in basketball. It’s impossible to fully understand a complex system by reducing it to its component parts – like just shooting or dribbling, for example, doesn’t fully explain a basketball game. And yet, that’s what mainstream economics continually tries to do as it clings to simplistic models and diagrams that try to mimic the laws of physics – like the ‘law’ of supply and demand, for example.

But the economy, like basketball, is an unpredictable system made up of decision makers (or agents in economics and players, coaches, and referees in basketball). The output of their interactions yields more than what is put into them which is what makes them non-linear. For example, a team of basketball players don’t simply stand in fixed positions passing the ball in a linear predictable fashion. They’re agents who take in a fixed set of inputs and decide how to make the most of them with the knowledge and skill they possess.

And these agents are not perfectly rational in their decision making, as mainstream economists assume them to be. Their rationality is limited, or bounded, by their capabilities, emotions, time, circumstances, or myriad of other distractions, preferences, or constraints. But they learn and adapt, often through interactions that are in constant motion and always changing. And each little micro-movement of behavior that comprises an interaction yields a new, novel, and emergent outcome that sometimes reveal patterns.

Because structure is imposed on the game (or the economy), order emerges from those micro-movements of activity creating a rhythm or pattern at a macro-level. For example, the rhythm and cadence of a basketball game that can sometimes emerge out of a fast break, or successive fast breaks. The opposing team’s coach recognizes that pattern; often times prompting them to stand up and call a time out just to disrupt the pattern. These continual sources of novelty self organize and perpetuate creating evolutionary momentum – like a hot shooter swept up in the flow of a game.

INTERACTION GAINS TRACTION

The global economy behaves much the same way and can be described by the same three layers of matrixed interactions mentioned earlier.

One layer of interaction is happening between the decision makers (or actors) in an organization and their teammates and competitors within the structure of local, state, and international law. Any one employee has the potential to be effective in the game of commerce, including the choice to do so. And they can’t do just anything, there are rules to commerce and certain social constructs that influence their behavior.

More interactions happen at a locational level; at local, regional, national, and global scales. Even at a local level there are interactions between employees within an office, floor, or building or between buildings in larger corporations. Regional managers in large institutions interact with a network of affiliates across a diverse set of geographies who in turn are interacting locally and with other regions. Global corporations interact at a national level, but also around the globe with other states and regions who are in turn interacting with networks of countries and areas everywhere.

A third layer includes social, political, and economic interactions and transactions between people and institutions in a vast complex array spread across territories near and far. Small business associations interact with local elected officials to enact laws and regulations while CEOs of mega-corporations convene and conspire with international monetary organizations and world leaders to control and evolve world economic policies.

There are interactions occurring within and between each of these layers creating a matrix of interconnections. In basketball, we tend to be drawn to a particular player or their jump shot and not to the interactions they have had, are having, or are about to have between them and their teammates, coaches, and referees across the entire expanse of the court, over the course of the game, or across locations over the course of season.

The same is true in economics. We tend to focus on a CEO or a company’s performance or a political leader and their nation’s GDP. We’re not obsessing over the interactions occurring within and between the various relationships that interconnect corporate structures, policies at different scales of geography, or interactions between economies, societies, and their various localities.

Distinguished Professor of Geography at the National University of Singapore, Henry Wai-chung Yeung quotes two researchers studying how organizations relate and interact. He uses it to make an argument for why it’s more important to focus on the interaction between entities than the entities themselves.

“Taking a relational orientation suggests that the real work of the human organization occurs within the space of interaction between its members. Thus, the theorist must account for the relationships among, rather than the individual properties of, organizational members.”1

Though Yeung also reminds us these theories too are drawn from physics. Quantum physics. It turns out there have been attempts by economists to pull away from Newtonian comparisons for also most as long as they’ve been around.

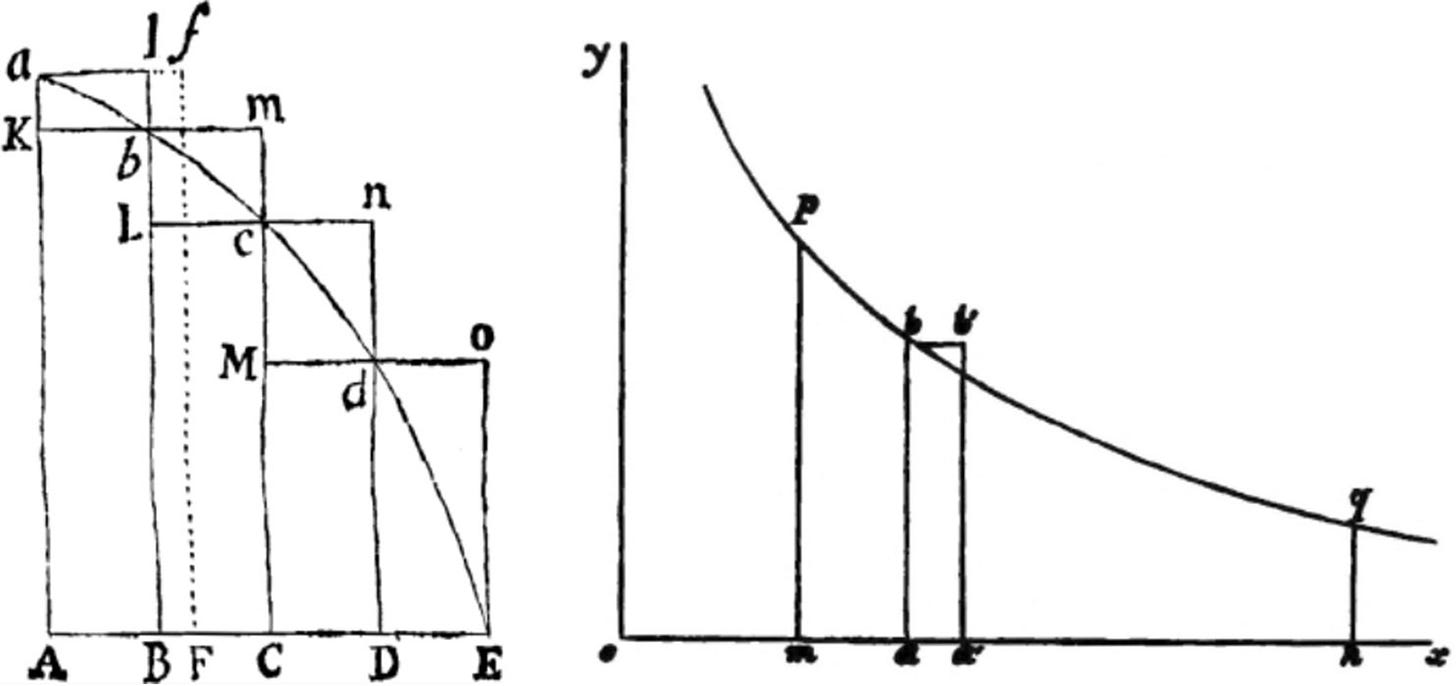

It was the British economist, William Stanley Jevons, who in 1871 devised the first ‘law of demand’ by drawing a graph that mimicked Sir Isaac Newton’s 1687 graph depicting his theories on the laws of motion. Borrowing Newton’s idea of an atom as the single foundational unit that defines the laws of motion, Jevon’s invented the ‘single average individual, the unit of which population is made up.’ 2

It is from this oversimplification that he arrived at what he called the ‘calculating man’ — a perfectly rational human who maximizes the utility of their decisions. Jevons then came up with the ‘law of diminishing returns’ which states the more something is consumed, the less desirable it becomes. We don’t have to look far to see that is not universally true. Certainly not as true as the laws of motion.

But going back to the 1870s, I can imagine the allure of this theory. As evidenced in how Jevons’ describes markets being pulled into equilibrium just as gravity pulls a pendulum to rest,

“Just as we measure gravity by its effects in the motion of a pendulum, so we may estimate the equality or inequality of feelings by the decisions of the human mind. The will is our pendulum, and its oscillations are minutely registered in the price lists of the markets.”3

But he goes on to admit that economists did not yet have the tools to measure this dynamically.

“I know not when we shall have a perfect system of statistics, but the want of it is the only insuperable obstacle in the way of making Economics an exact science.”4

I suspect if Jevons were alive today, he would be scratching his head as to why more economists have not embraced complexity science to inch economics closer to an exact science. He’d be dismayed at how mainstream economists have resorted to just standing in the corner of the court arrogantly waiting for the ball to be thrown to them. He’d be screaming, “MOVE WITHOUT THE BALL! MOVE WITHOUT THE BALL!”

And they would; because he’s Jevons – one of the first economic stars in the league. And when they do, they’ll immediately experience how new situations and interactions continually emerge and how their reactions will be constantly different. And when they get the ball, the attention, interaction, and other economists will converge on them.

And then, as quickly as the moment arises, they pass to the next person and everything diverges again. These split-second cycles of emergence, convergence, and divergence of economic thoughts, theories, and actions would swirl in continual motion. Each intentional or random action from any economist, the market, politicians, or society would send the cycle spinning in another trajectory. A complex system of complexity economists lost in the perpetual momentum of the flow of the game.

And there, sitting at courtside, would be the great Sir Isaac Newton rising from his chair with his hands over his head and then sitting down. Only to rise and do it again. A single initial condition that would surely prompt others to do the same. Soon a pattern emerges as other fans join in. Pretty soon a self-organized wave propagates among the crowd and around the gym.

Each individual deciding to interact in response to a changing condition they observed in their environment constrained by the structure of the gym to forms a perpetual wave. Another complex system initiated through a set of initial conditions through the act of a single individual who decided not to just arrogantly stand there.

Rethinking relational economic geography. Henry Wai-chung Yeung. 2004.

Ibid.

Ibid.

Reference:

The Handbook of Evolutionary Economic Geography. Edited by Ron Boschma. Utrecht University; Ron Martin, University of Cambridge, UK. 2010.