Hello Interactors,

We’ve entered fall here in the northern hemisphere, and you know what that means — pumpkin spice everything, cozy sweaters, and … economics! That’s right, as the leaves change color (at least for those above 40°N latitude), it’s the perfect time to explore how the changing seasons mirror shifts in human interaction, from the flow of resources to the balance of power and progress.

This week, it’s time to cozy up with Adam Smith, Jeremy Bentham, and James Watt —three names you probably didn’t expect to find together, but trust me, they make quite the trio. So grab your favorite fall beverage and join me on a journey through the Industrial Revolution, steam engines, and the forgotten role of moral feedback loops in economics.

Let's find out why balancing wealth and well-being is harder than finding a public restroom in an old university.

PURGING THE URGE FOR SYMPATHY

I needed to pee. More specifically, the stretch receptors in the walls of my bladder, which monitor the volume of urine inside, became activated. That sent sensory signals to the spinal cord and brain through my pelvic nerves. The pons in the brainstem (which includes a dedicated urination control center) processed this information in coordination with my prefrontal cortex, which allowed for conscious control over my decision to urinate.

It was a Sunday, and the campus was dead. Lucky for me a door was open, so I ducked in and began my search for a potty. The hallway was musty and narrow. The walls were old, but not as old as the 250-year-old structure surrounding it. There was no immediately visible sign for a restroom, but there were numerous potential doors and directions for me to attempt. As I approached one of them, the industrial grade door magically opened before I could even touch it. I cautiously inched forward half wondering if it would lock behind me.

Now inside another chamber further in the interior, I was met with another set of mysterious doors. I stepped inside another narrower hallway that twisted suddenly to a sign above another door that read WC. Whatever Potter-esque ghosts had guided me here clearly had sympathy. And so did my parasympathetic nervous system. It simultaneously signaled the detrusor muscle of my bladder wall to contract and my urethral sphincter to relax. I stood there in relief wondering if I could find my way out.

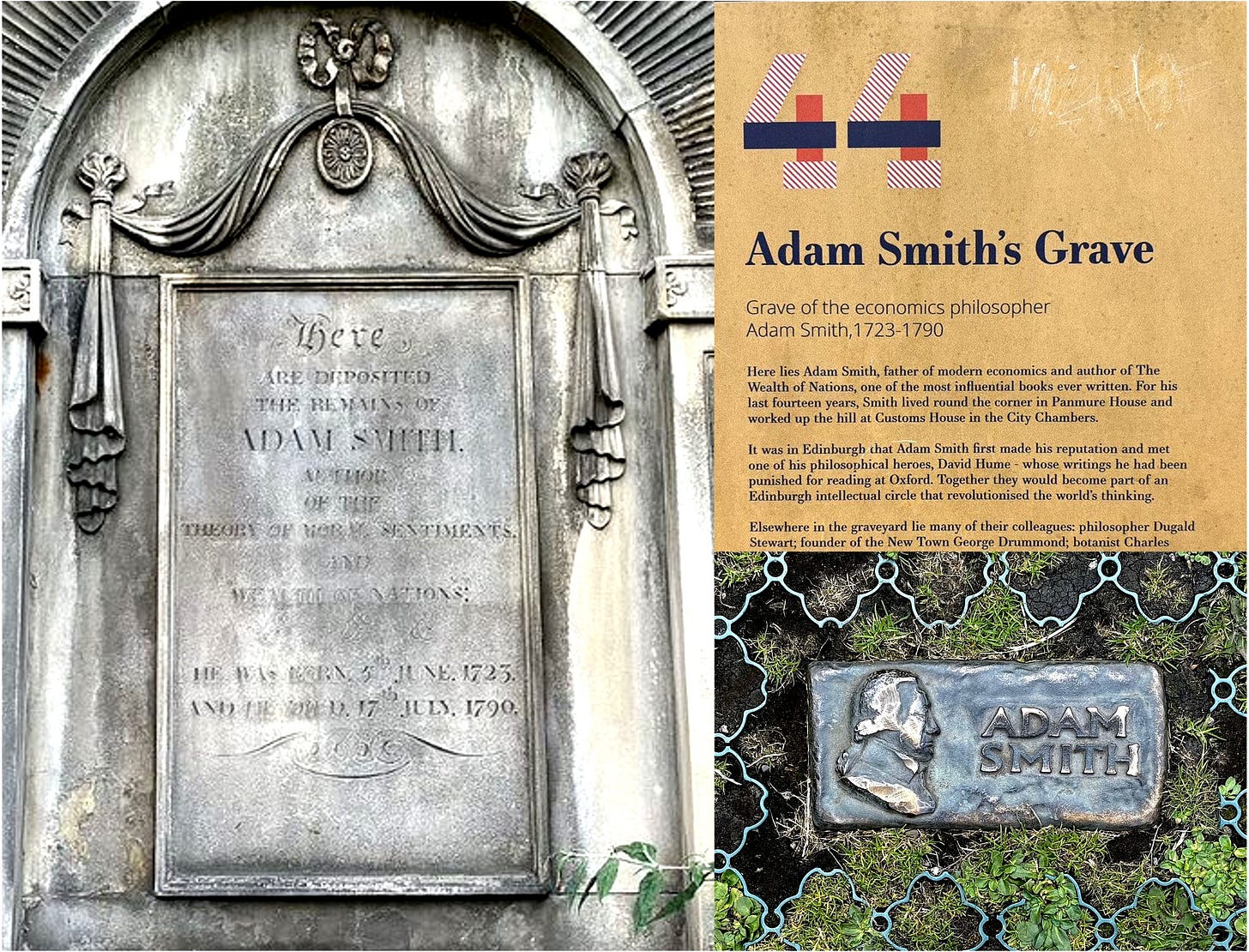

I was visiting the University of Glasgow, hoping to learn more about its famous figures, especially Adam Smith, whom I see as an important moral philosopher rather than just the “father of economics.” A few days later in Edinburgh, I tortured my family by leading them on a search for his gravestone. I was pleased to find it acknowledged his The Theory of Moral Sentiments, where sympathy balances self-interest, as well as his more popular The Wealth of Nations. Unsurprisingly, the nearby tourist plaque focused only on Wealth of Nations, reflecting the emphasis on economics over his broader moral philosophy.

Adam Smith's moral philosophy was central to his life's work, with The Theory of Moral Sentiments being his enduring focus, while The Wealth of Nations but a brief but significant interlude. For Smith, economics was not just about market mechanics, but deeply intertwined with human nature, ethics, and the broader pursuit of communal well-being. He was more concerned with the motivations behind human actions than with the technical details of market forces, which came to dominate modern economics. Smith believed that the drive for self-betterment was not solely about personal wealth but was intrinsically linked to the well-being of communities, where self-interest was balanced by sympathy for others.

In Smith’s view, economic actions should be guided by moral virtues, such as prudence and justice, ensuring that individual efforts to improve one’s own life would ultimately contribute to the greater good of society. His exploration of economics was always part of a larger moral framework, where community engagement and ethical behavior were essential for both individual and societal progress.

Today, this broader moral context is often overlooked, but for Smith, economics was inseparable from philosophical inquiry into human behavior. He emphasized how the improvement of human life goes far beyond just the accumulation of material wealth.

MORALS MEET MARKET MANIPULATION

Many conservatives today may brush this interpretation as being too ‘woke’. Well, some eventually did back then too. As the British economy was expanding in Smith’s later years, he spoke in favor of capping interest rates with usury law. Usury is defined as the practice of making unethical or immoral loans that unfairly enrich the lender, often involving excessive or abusive interest rates. He believed exorbitant rates could lead to preying on the disadvantaged during a time of need resulting in growing disadvantages to the larger community.

Historically, many societies including ancient Christian, Jewish, Islamic, and Buddhist communities considered charging interest of any kind as wrong or illegal.1 Smith was rooted in elements of Christian morals, but critics claimed he was being hypocritical. They pointed to examples in his publications, often out of context, of where he suggested government can’t know better than individuals about their own risks, costs, and benefits and thus should not meddle.

But even in The Wealth of Nations Smith was clear about three conditions necessary for an effective economy and with each he paired moral values also found in The Theory of Moral Sentiments:2

State-Justice: Smith argued, “Commerce and manufacturers…can seldom flourish long in any state which does not enjoy a regular administration of justice,” emphasizing the need for laws that ensure security and regulate excessive accumulation of wealth.

Market-Liberty: He valued the “liberty of trade…notwithstanding some restraints,” while warning that monopolies “hurt…the general interest of the country.”

Community-Benevolence: Rooted in moral sentiments, Smith believed in a shared commitment to community, where “many reputable rules…must have been laid down and approved of by common consent.”

Smith’s main usury critic was the philosopher Jeremy Bentham, known for developing the philosophy of utilitarianism. A letter written to Smith in 1787 stated:

“Should it be my fortune to gain any advantage over you, it must be with weapons which you have taught me to wield, and with which you yourself have furnished me…I can see scarce any other way of convicting you of any error or oversight, than by judging you out of your own mouth.”3

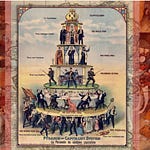

Bentham is most famous for the idea of “maximizing the greatest happiness for the greatest number” which helped promote legal reforms and social progress including welfare, equal rights for women, the separation of church and state, and the decriminalization of homosexual acts. But his ultimate focus of utilitarianism was on the practical outcomes of policies going so far as to develop mathematical formulas, called felicific calculus, to determine how much pleasure or pain must be inflicted in society to achieve the most happiness for the greatest number.

He was also a staunch economic expansionist, believing, as verified in his calculus, that it would expand good for most. It would be his student, John Stuart Mill, who expanded on but also critiqued Bentham’s utilitarianism later in the mid 1800s.

“I conceive Mr. Bentham's writings to have done and to be doing very serious evil. It is by such things that the more enthusiastic and generous minds are prejudiced against all his other speculations, and against the very attempt to make ethics and politics a subject of precise and philosophical thinking.”4

Mill too was an expansionist, but acknowledged utilitarian reasoning could be used to defend exploitive and immoral colonial practices, including slavery. Mill believed slavery "effectually brutifies the intellect"5 of both slave and the enslaver and condemned the notion that certain races were inherently inferior and required subjugation.

Nevertheless, early colonizers and imperialists, as well as modern day neo-liberals weaponized elements of utilitarianism much like they did with The Wealth of Nations. They used (and continue to use) select elements to justify laissez-faire economics, deregulation, and the exploitation of labor, often prioritizing economic efficiency over moral considerations such as fairness and social equity.

For example, Margaret Thatcher and Ronald Reagan both used utilitarian logic believing their policies would maximize overall economic growth and prosperity, benefiting society as a whole, even at the expense of rising inequality and social welfare. Their consequentialist approach justified market-driven reforms for a perceived greater good. Given today’s historic wealth imbalances, the result of that calculus is less than convincing.

Bentham also failed to convince Smith in that fateful letter, but to many it marked a notable shift in economic thinking and philosophy. Smith passed away three years after his exchange with Bentham and theoretical mathematical utilitarianism became the ultimate measure of right and wrong in governance and ethics in the UK and the US.

Smith’s morality, which emphasized moral virtues guiding economic actions, lost out to consequentialisms focus solely on outcomes, often justifying exploitation and suffering if it maximized societal gain and economic expansion for the expansionists — despite John Stuart Mill’s, and countless others, objections.

ECONOMIC ENGINES IN MORAL MACHINES

During Adam Smith’s lifetime, the Industrial Age rapidly emerged, transforming economies and wealth structures. Technological advancements, like the steam engine, fueled industrial capitalism, driving unprecedented economic growth and wealth accumulation. This focus on efficiency relied on maximizing productivity, whether through steam-powered machines, the exploitation of enslaved people, the working poor, or the displacement of Indigenous populations, prioritizing economic gain over human well-being.

In 1783, while Smith and Bentham were debating economic philosophy, James Watt was at the University of Glasgow, focused on regulating unchecked power —specifically the excessive speed of steam engines which he helped to invent. To prevent mechanical failures from fluctuating steam pressure, Watt invented the centrifugal governor. This device used weighted iron balls that spun outward with centrifugal force as the engine’s speed increased, raising a spindle that adjusted a valve to control steam flow.

By automatically reducing steam when the engine ran too fast and increasing it when it slowed, the governor ensured safe and efficient operation. Watt's invention, introduced in 1788, was in full production by 1790, paving the way for innovations like the first steam locomotive in 1804.

Watt's governor symbolized the need to impose limits on unchecked mechanical power, ensuring the engine operated within safe and efficient parameters. This technological innovation mirrored a broader theme of the Industrial Revolution — the balance between harnessing new, powerful technologies for economic growth while recognizing the risks of unregulated force, whether in machines or the rapid, unrestrained accumulation of wealth and resources in society. Watt’s governor was an early acknowledgment that unchecked power, whether mechanical or economic, could lead to instability and disaster.

"I am never content until I have constructed a mechanical model of the subject I am studying. If I succeed in making one, I understand. Otherwise, I do not."

– Lord Kelvin

Our brains also act as a kind of governor on the unchecked power of our kidneys, just as moral feedback loops serve as a governor on unchecked economic ambition. Like the stretch receptors in our bladder sensing when fluid volume builds, moral reasoning, as Smith envisioned, detects the social and ethical consequences of unfettered economic expansion. These signals, akin to the centrifugal force moving the governor's spindle, prompt individuals and society to regulate their actions, guiding decisions based not only on self-interest but on moral duty.

In contrast, Bentham's utilitarian calculus, much like a theoretical mathematical model divorced from natural systems, ignores these ethical feedback loops. By relying solely on abstract calculations of happiness and efficiency, Bentham's approach, like a machine operating without awareness of its environment, risks distorting human and social behaviors. Where Smith's model calls for moral constraints on economic behavior, much like the body’s signals to prevent overstretching, Bentham’s framework lacks the necessary human safeguards, leading to potential exploitation and imbalance in pursuit of theoretical utility maximization.

I do wonder what our economic systems would look like if, like our bodies, they were designed to self-regulate, ensuring that the pursuit of wealth doesn’t come at the expense of human well-being? Just as our bodily functions rely on natural feedback loops to maintain equilibrium, why have we allowed our economies to run unchecked, often leading to exploitation and inequality? Adam Smith believed in moral constraints on ambition, yet today, much of our economic thinking prioritizes growth without those safeguards.

As walked off campus that day, I reflected on Watt’s governor regulating the steam engine and the moral feedback loops Smith envisioned. I wondered if Smith and Watt made the metaphoric connection in their encounters with one another, maybe even on their way to relieve themselves in the very building in which I found myself. Perhaps they each happened on this connection in their own thought experiments, which makes me wonder why more don’t today? Surely there’s a morally sound way to balance personal gain with the greater good — a bit like public restrooms.

Usury. Wikipedia, The Free Encyclopedia. Last modified October 5, 2024. https://en.wikipedia.org/wiki/Usury.

Weed, Brad. "Is the 'Invisible Hand' Pushing a Smith Myth?" Interplace. November 19, 2022. https://interplace.io/p/is-the-invisible-hand-pushing-a-smith

Diesel, Jonathon. "Adam Smith on Usury: An Esoteric Reading." Journal of Economic Behavior & Organization 184 (April 2021): 727-738.

Mill, John Stuart. Early Essays. Edited by A. J. S. Teixeira. London: Longmans, Green, and Co., 1875. 403.

Mill, John Stuart. Principles of Political Economy. 7th ed. London: Longmans, Green, and Co., 1871. 315.